north carolina estate tax certification

28A-21-2a1 is not required for a decedent who died on or after 112013. Ad Access Tax Forms.

Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 Check out the most significant web library of legally binding templates for personal and company needs to obtain the one youre looking for.

. Inheritance And Estate Tax Certification. Instant access to fillable Microsoft Word or PDF forms. Estate Tax Certification For Decedents Dying On Or After 1 1 99 Form.

Find a courthouse Find my court date Pay my citation online. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. 28A-21-2a1 is not required for a decedent who died on or after 112013.

For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form.

Estate Tax Certification For Decedents Dying On or After 1199 Files. This is a North Carolina form. SUBSTANTIAL INVOLVEMENT IN ESTATE PLANNING LAW.

Average of at least 500 hours a year. Eligible - Has met NCDOR educational requirements for assessor and is qualified for the position but may or may not have been an assessor in the past. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration.

This Resolution states that the Register of Deeds will no longer accept any deed transferring real. Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. Use this form for a decedent who died before 111999.

28A-21-2a1 is not required for a decedent who died on or after 112013. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. North Carolina Taxes- Current Update Feb 2022.

Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. An estate tax certification under GS. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99.

Use this form for a decedent who died on or after 111999 but prior to 112013. In addition applicants must demonstrate involvement in specific estate planning activities as defined. An estate tax certification under GS.

Home County Budget County Calendar. As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the Davidson County Board of Commissioners on August 14 2018. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

Minimum of 400 hours for any one year. Estate Tax Certification For Decedents Dying On Or After 1 1 99. For a decedent who died before 111999 use AOC-E-207.

Ad North Carolina Taxes Same Day. NA - Individual is a certified appraiser but is not eligible to be the assessor nor have they ever been a certified. Inheritance And Estate Tax Certification Form.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. USLF amends and updates the forms.

County Assessor and Appraiser Certification Table NCDOR. Service as a law professor for one year. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

Appointments are recommended and walk-ins are first come first serve. To be a certified assessor the provisions of NCGS 105-294 must be met. Every single template is completed by state-specific attorneys and updated regularly.

Save the file you need to your device or the cloud and reuse it time and time again. This is a North Carolina form and can be use in Estate Statewide. Mecklenburg North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 An expertly drafted template is ready and waiting for obtain in the US Legal Forms collection.

Receipt of an LLM. Use this form for a decedent who died on or after 111999 but prior to 112013. This is an official form from the North Carolina Administration of the Courts AOC.

Complete Edit or Print Tax Forms Instantly. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Degree in taxation or estate planning and probate law.

Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Home County Budget County Calendar. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. For a decedent who died before 111999 use AOC-E-207.

An estate tax certification under GS. Estate Tax Certification For Decedents Dying On. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. Estate Tax Certification For Decedents Dying On Or After 1199. North Carolina Judicial Branch Search Menu Search.

Get Access to the Largest Online Library of Legal Forms for Any State. Walk-ins and appointment information. Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate.

Does North Carolina Collect Estate Or Inheritance Tax

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions

Incredible Castles Around The World Castle Biltmore House Biltmore Estate

Understanding North Carolina Inheritance Law Probate Advance

![]()

North Carolina Estate Planning Elder Law Articles Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

Illinois Guardianship Estates For Minor Children Reda Ciprian Magnone Llc Estate Lawyer Guardianship Estate Planning

Understanding North Carolina Inheritance Law Probate Advance

Vincent Allen Project Archives The Old House Life Old Things Updating House Old House

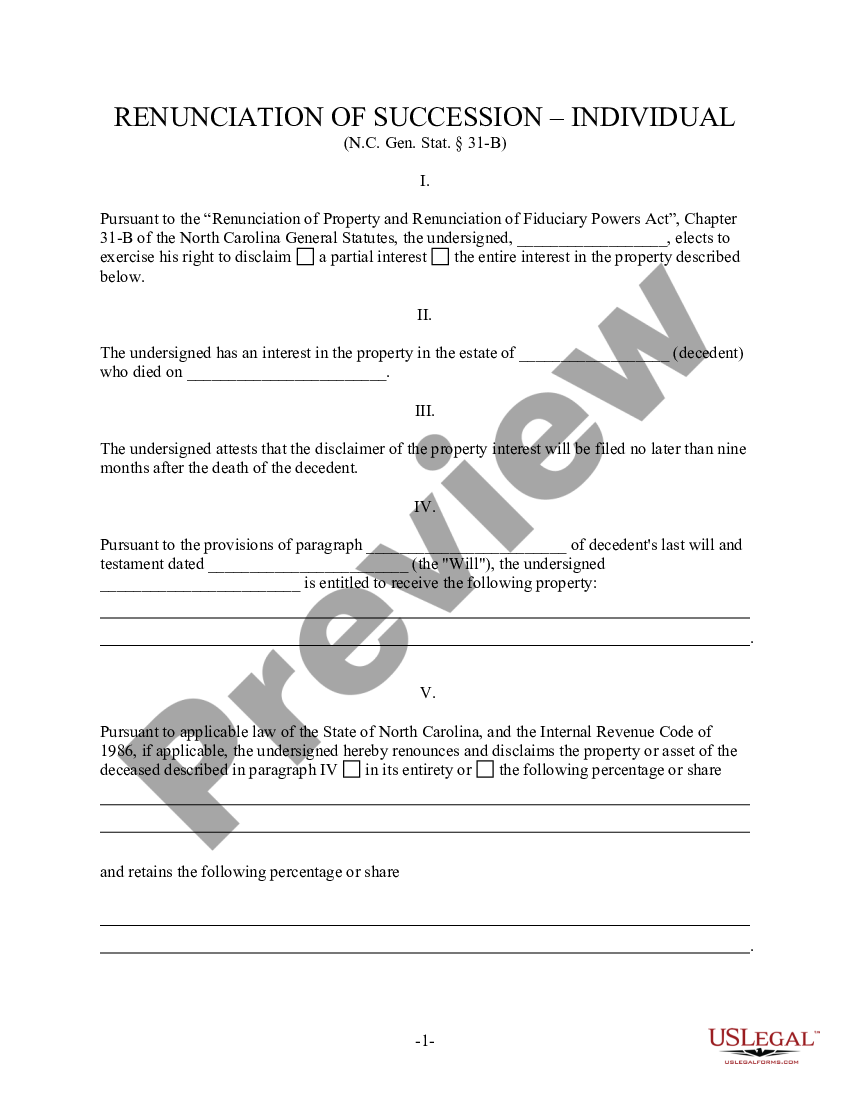

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms